The co-founder of Hadoop, the technology that sparked the big data revolution of the 2010s, is back with a new venture that aims to solve what he calls the industry’s most persistent problem. Arun Murthy, former chief technology officer at Scale AI, has emerged from stealth with Isotopes AI, a startup that has raised $20m in seed funding to build artificial-intelligence agents that bridge the gap between complex data infrastructure and the business managers who need insights from it.

Isotopes launched on Thursday with backing from NTTVC, led by Vab Goel. The company’s flagship product, an AI agent called Aidnn, allows business executives to query their company’s data using natural language, drawing information from enterprise software such as Salesforce, finance applications, and cloud storage systems. The technology is sophisticated enough that the startup has already applied for ten patents, according to Mr Murthy.

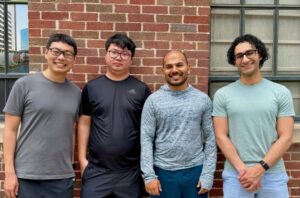

The founding team carries considerable pedigree in data infrastructure. Over two decades ago, Mr Murthy worked at Yahoo on the team that built Hadoop, the open-source project that became the foundation for the big data industry. Yahoo spun the technology into Hortonworks in 2011, with Mr Murthy as co-founder and chief product officer. The company went public in 2015 but eventually merged with rival Cloudera, which was taken private in 2021. His co-founders, Prasanth Jayachandra and Gopal Vijayaraghavan, are also Hortonworks alumni.

THE INTELLIGENCE: What It Means

This funding round signals a broader shift in enterprise software, where artificial intelligence is being deployed to democratise access to complex business data. The $20m seed round—substantial for an early-stage company—reflects investor confidence that AI agents represent the next evolution in business intelligence tools.

The timing appears deliberate. Mr Murthy recalls his frustration during his tenure at Cloudera, where executives on quarterly earnings calls with Wall Street analysts often could not answer questions about operational details because they lacked access to the relevant data. This disconnect between data and decision-makers has persisted despite decades of investment in business intelligence platforms.

What sets Isotopes apart from the crowded field of AI-powered analytics tools is the team’s deep understanding of enterprise data architecture. The agent can locate data across disparate systems, clean it, and maintain contextual memory for complex, multi-step analytical tasks. This technical sophistication suggests the company is targeting enterprise clients with complex data environments rather than smaller businesses seeking simple analytics.

The valuation implications are significant. A $20m seed round typically values a company at $80m-$120m post-money, indicating investors believe Isotopes can capture meaningful market share in the enterprise AI market, which is projected to reach $50bn by 2027. The fact that NTTVC led the round, with managing partner Vab Goel (formerly of NorWest Ventures) taking the lead, suggests confidence from established enterprise software investors.

THE BRIDGE: What To Do About It

For venture capitalists seeking exposure to the enterprise AI boom, several patterns emerge from this funding round. Investors should look for teams with deep domain expertise in enterprise infrastructure—particularly those who have experienced the pain points firsthand. The Isotopes founding team’s track record of building and scaling data infrastructure companies provides a template for evaluating similar opportunities.

Similar opportunities worth watching:

- WisdomAI: Recently raised $23m for AI-powered data analysis with hallucination-reduction technology

- DataSnipper: European startup building AI agents for financial data analysis, currently raising Series B

- Semantic Layer startups: Companies building AI-native data abstraction layers, particularly those with enterprise sales traction

Active investors in this space:

- NTTVC: Now actively seeking AI infrastructure deals, particularly those with enterprise focus and technical depth

- Scale Venture Partners: Historical focus on data infrastructure, likely monitoring AI agent opportunities

- Lightspeed Venture Partners: Recently announced dedicated enterprise AI fund, seeking technical founding teams

- Bessemer Venture Partners: Portfolio includes multiple data infrastructure companies, active in AI agent thesis

For founders in adjacent markets, the Isotopes playbook offers several insights. First, enterprise customers increasingly value solutions that can be deployed without sharing sensitive data with external AI model providers, suggesting on-premises or private cloud deployment capabilities are becoming table stakes. Second, technical sophistication in AI agent reasoning and multi-step planning appears to command premium valuations from investors.

The competitive landscape, however, remains formidable. Established players like Salesforce’s Tableau already offer agent capabilities amid the company’s broader AI agent strategy, while numerous well-funded startups are targeting similar opportunities. Success will likely depend on execution speed and the ability to demonstrate clear return on investment for enterprise customers facing pressure to justify AI spending.

For enterprise buyers evaluating AI agent solutions, the Isotopes launch highlights the importance of technical depth in vendor selection. Simple chatbot interfaces layered on existing business intelligence tools are unlikely to solve complex analytical workflows. Instead, buyers should prioritise vendors with proven experience in enterprise data architecture and the ability to handle multi-step, contextual analysis tasks.