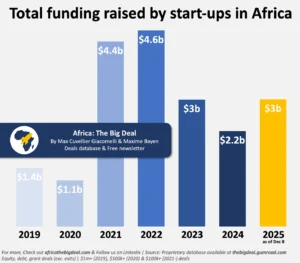

African startups raised $3 billion in funding in 2025. That’s the most funding in three years.

Here’s what happened before:

- 2022: $4.6 billion (the most ever)

- 2023: $2.9 billion (dropped a lot)

- 2024: $2.2 billion (dropped again)

- 2025: $3 billion (going back up)

So funding is better than last year, but still way below 2022.

Two companies went public in November through IPOs. Optasia in South Africa raised $345 million at a $1.4 billion valuation. Cash Plus in Morocco raised $82.5 million at a $550 million valuation. This is the first IPO activity in Africa since 2019. Six whole years.

Almost all the funding went to four countries: Kenya, Nigeria, South Africa, and Egypt. Out of every $100 in funding, $83 went to these four countries. Only $17 went to all the other countries combined.

Twenty African countries got zero funding. Nothing at all.

Kenya raised the most: $638 million. That’s 29% of all African startup funding.

Here’s something interesting: The two companies that went public are really old. Optasia is 21 years old. Cash Plus is 18 years old. That’s how long it takes to IPO in Africa.

But acquisitions happen faster. Last week, Capitec acquired Walletdoc for $23.5 million. Walletdoc was only 10 years old. Another company called Paystack started in 2015 and got acquired by Stripe for $200 million in 2020. Just five years.

So if you want an exit in Africa: Acquisitions are much faster than IPOs.

The companies raising funding in 2025 aren’t early-stage. They’re mature companies with revenue that need growth capital.

LemFi raised $53 million in Series B. They do cross-border payments. PowerGen raised $50 million. They do distributed energy with solar. Spiro raised $100 million. They make electric vehicles. Moniepoint raised $90 million in Series C. They do fintech in Nigeria.

These aren’t seed rounds for new ideas. These are late-stage rounds for companies with proven business models.

Here’s another thing: Startups raised $935 million in debt financing instead of equity. That’s a lot. When you raise debt, you have to pay it back with interest. When you raise equity, you don’t pay it back, but you give up ownership.

Why are they raising debt instead of equity? Because investors won’t pay high valuations anymore. So founders would rather take debt and keep more equity.

Three big questions:

First: Most of the funding came late in the year. In October, two companies (Spiro and Moniepoint) raised $190 million together. Remove those two deals, and 2025 doesn’t look so strong. When just two deals make the whole year look good, that’s not a healthy ecosystem.

Second: These 238 companies raised $3 billion. But what happens next? If they don’t show revenue growth or reach profitability in the next 18 months, investors will stop funding them in 2027.

Third: Only two IPOs after six years of zero. And both companies are almost 20 years old. That means if you start a company today, you might wait until 2045 for an exit. That’s a really long time.

What To Watch

Here’s how to know if this recovery is real:

By June 2026: If startups raise more than $1.2 billion in H1 2026, the recovery has momentum. If they raise less than $800 million, then 2025 was just a spike from a few large deals.

By December 2026: If at least 3 companies exit for $100 million+ (through acquisition or IPO) in 2026, the exit market is healing. If zero or one company exits at that level, then nothing really changed.

By March 2027: If the companies that raised Series A/B in 2025 are raising follow-on rounds in 2026-2027 at flat or up valuations, the fundamentals are solid. If they’re raising down rounds at 50% lower valuations or getting acquired at fire-sale prices, then the 2025 funding went to the wrong companies.

What This Means

If you’re a founder: Funding is back, but exits take 20 years. Don’t build for the next round. Build for profitability.

If you’re an investor: Africa is recovering, but it’s not fixed. The startups that raised in 2025 can survive funding winters. But we don’t know yet if they can generate venture-scale returns.

Want more analysis like this? I break down African funding news every week using the same frameworks VCs use: what the numbers really mean, how business models actually work, and what will happen next. No press release regurgitation. Subscribe to get these in your inbox: [Subscribe]