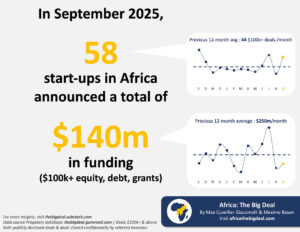

African startups raised $140 million in September 2025, maintaining consistency with September 2024 ($146 million) and exceeding September 2023 ($124 million), while Q3 2025 totaled $785 million—surpassing Q3 2024 ($649 million), Q3 2023 ($496 million), and Q3 2022 ($612 million) despite broader year-over-year funding decline.

The continent has raised $2.2 billion year-to-date through September, approaching 2024’s full-year total of $2.24 billion with three months remaining. However, the trajectory reveals uneven quarterly performance: Q1 raised $461 million, Q2 peaked at $963 million, before Q3’s $785 million pullback.

Equity financing dominated September with $105 million (75%) of total capital, while debt contributed $32 million and grants provided $3 million. The grant allocation included 16 match-funding awards from DEG Impulse’s develoPPP Ventures program targeting East African startups.

Deal Size Concentration Increases

The five largest September transactions captured significant capital share: Nigerian fintech Kredete raised $22 million Series A, non-startup Pura Beverage secured $15 million Series B, South African identity verification firm Contactable closed $13.5 million, Egyptian AI startup Intella raised $12.5 million Series A, and South African edtech The Invigilator obtained $11 million.

These five deals totaled $74 million—53% of monthly funding flowing to five companies. This concentration pattern differs from deal count metrics showing September recorded the second-highest number of ventures raising at least $100,000, trailing only July’s performance.

The divergence between deal count and capital concentration indicates increased Series A and B activity capturing larger check sizes, while seed and pre-seed rounds contributed dealflow volume without proportional capital deployment. For African ecosystem health, this suggests maturing companies attracting institutional capital while early-stage funding remains constrained.

M&A Activity Provides Alternative Liquidity

September recorded five acquisitions: Twofold Capital-led consortium acquired South African fintech TaxTim, edtech Rekindle bought EpiTek, fintech Street Wallet acquired Digitip, Moroccan super app Ora Technologies purchased logistics startup Cathedis, and Egyptian healthtech Duaya acquired EXMGO.

Exit activity matters for ecosystem sustainability. Venture capital requires liquidity events generating returns that justify continued investment. African startup exits historically concentrate in acqui-hires or distressed asset sales rather than strategic acquisitions or IPOs delivering meaningful returns.

The five September transactions suggest consolidation acceleration as larger African platforms acquire smaller competitors or complementary capabilities. However, disclosed transaction values remain limited, preventing assessment of whether acquisitions delivered investor returns or represented defensive moves by struggling companies absorbing competitors.

Quarterly Performance Contextualized

Q3 2025’s $785 million represents 18% decline from Q2’s $963 million but maintains improvement over Q3 in three prior years. The sequential drop from Q2 could indicate seasonal patterns (Q2 includes major African tech conferences), macroeconomic headwinds, or portfolio companies delaying rounds until demonstrating additional traction.

Comparing year-over-year Q3 performance provides a clearer signal: 2025 exceeded 2024 by 21%, surpassed 2023 by 58%, and beat 2022 by 28%. This consistent improvement across multiple years validates African ecosystem growth trajectory despite funding environment challenges affecting global venture markets.

The $2.2 billion year-to-date total approaching 2024’s full-year figure with Q4 remaining suggests potential for a record fundraising year. However, Q4 performance historically varies significantly based on year-end fundraising rushes or investor capital deployment deadlines.

Debt Financing Composition

The $32 million debt component warrants scrutiny. African startups historically struggle accessing venture debt due to limited asset bases, currency volatility, and underdeveloped debt markets. Debt providers require revenue visibility and asset collateral typically unavailable to early-stage ventures.

Potential debt sources include revenue-based financing (increasingly popular among African SaaS companies), trade finance facilities (for e-commerce and logistics startups), or development finance institution loans (structured as quasi-equity with concessionary terms).

Commercial venture debt availability indicates institutional confidence in African startup repayment capacity. Concessional development finance suggests continued subsidy dependency rather than commercial sustainability.

Grant Funding Strategic Role

The $3 million grant allocation through DEG Impulse’s develoPPP Ventures East Africa program represents non-dilutive capital reducing equity dilution for early-stage companies. However, grants create dependency risks if startups optimize for donor priorities rather than commercial viability.

Investment Implications for Africa-Focused VCs

September’s performance reinforces several trends affecting African venture strategy:

Deal concentration increasing: Top five deals captured majority capital, requiring VCs to compete for access to breakout companies while avoiding trapped capital in subscale ventures.

Series A environment improving: Multiple $10 million+ rounds indicate institutional capital availability for companies demonstrating traction, contrasting with persistent seed-stage constraints.

Exit market developing: Five acquisitions provide portfolio liquidity though transaction values remain modest compared to mature markets.

Quarterly volatility persisting: 18% Q2-to-Q3 decline suggests fundraising remains lumpy and unpredictable, complicating fund deployment pacing for portfolio construction.

For limited partners evaluating Africa exposure, the data supports continued allocation based on multi-year improvement trajectory despite quarter-over-quarter volatility. The $2.2 billion year-to-date figure approaching prior full-year totals with one quarter remaining indicates resilient ecosystem growth amid global funding contraction.

The critical question for Q4: Can African startups sustain momentum and surpass 2024’s full-year total, or will macroeconomic pressures and investor caution constrain year-end deployment? The answer determines whether 2025 represents inflection point or temporary recovery within prolonged funding winter.