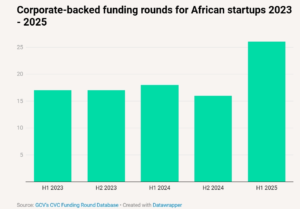

Corporate-backed deals in African startups just hit 26 in H1 2025—a 44% jump and the highest level since 2022. After two years flat (H2 2023–H2 2024), strategic investors are back. But the real story isn’t the number. It’s who’s writing the checks and why.

🎯 𝗧𝗵𝗲 𝗡𝘂𝗺𝗯𝗲𝗿𝘀: — 26 corporate-backed deals in H1 2025 — Previous ceiling: 18 deals per half-year — 44% increase = first sustained growth since 2022 correction — Fintech took 50% of deals ($162.8M+ disclosed) — Nigeria led with Moniepoint, OmniRetail ($20M Series A), Opay

📊 𝗖𝗼𝗺𝗽𝗮𝗿𝗶𝘀𝗼𝗻 – 𝗪𝗵𝗼’𝘀 𝗔𝗰𝘁𝘂𝗮𝗹𝗹𝘆 𝗗𝗲𝗽𝗹𝗼𝘆𝗶𝗻𝗴: This isn’t just European/North American capital anymore:

African corporates stepping up: — Flour Mills Nigeria → OmniRetail ($20M) – manufacturer backing the B2B platform it uses — OCP Morocco → Bidra Innovation Ventures ($250M fund, up to $5M checks) — Hollard Group SA → Naked Insurance ($38M Series B+)

Asian corporates entering: — MediaTek Taiwan → InfinLink Egypt ($10M semiconductors) — KuCoin → 7 of 12 Seychelles crypto deals

Global brands securing supply: — PepsiCo’s Kgodiso Fund → Khula SA ($7M agtech) — Spadel Belgium → Kumulus Water Tunisia ($3M water tech)

Compare this to 2019–2022 when corporate VC was 80%+ European/US capital. Now it’s diversified across continents.

💡 𝗕𝘂𝘀𝗶𝗻𝗲𝘀𝘀 𝗠𝗼𝗱𝗲𝗹 𝗥𝗲𝗮𝗹𝗶𝘁𝘆 – 𝗪𝗵𝘆 𝗖𝗼𝗿𝗽𝗼𝗿𝗮𝘁𝗲𝘀 𝗜𝗻𝘃𝗲𝘀𝘁 𝗗𝗶𝗳𝗳𝗲𝗿𝗲𝗻𝘁𝗹𝘆:

Corporate VCs don’t optimize for IRR and quick exits like traditional VCs. They optimize for strategic value:

Flour Mills → OmniRetail: Manufacturing giant backs the B2B ecommerce platform distributing its products. If OmniRetail scales, Flour Mills secures distribution. If it fails, they learned digital distribution firsthand. Win either way.

PepsiCo → Khula: Agtech marketplace connecting farmers to customers. PepsiCo gets supply chain visibility, smallholder farmer access, and early intelligence on agricultural innovation. The $7M is insurance against supply disruption.

MediaTek → InfinLink: Semiconductor company backs Egyptian chip startup with optical connectivity tech. MediaTek gets R&D partnership, African market entry point, and potential IP acquisition target.

Corporate investors hold longer (3-7 years vs VC’s 2-4 years), care less about valuation multiples, and bring distribution/customers/regulatory navigation that pure financial investors can’t.

⚠️ 𝗥𝗶𝘀𝗸 – 𝗪𝗵𝗮𝘁 𝗖𝗼𝘂𝗹𝗱 𝗞𝗶𝗹𝗹 𝗧𝗵𝗶𝘀 𝗧𝗿𝗲𝗻𝗱:

Integration execution risk: When Flour Mills invests in OmniRetail, can the startup maintain independence while serving its corporate investor’s strategic needs? Or does it become a captive vendor that loses appeal to other customers?

Geographic concentration: Big Four (Egypt, South Africa, Kenya, Nigeria) still get 80%+ of deals. First-time corporate deals in Tunisia, Ghana, Ethiopia are good signals, but single deals don’t make ecosystems. If these don’t lead to follow-on investments, they prove nothing.

Seychelles crypto bubble: 12 startups raised funding in H1 2025, 8 were crypto, KuCoin backed 7. This isn’t ecosystem diversity—it’s one exchange creating a captive deal flow. When KuCoin pulls back (regulatory pressure, market correction), Seychelles collapses.

Sector imbalance: Fintech = 50% of deals. Agritech = 2 deals. If corporate capital stays concentrated in one sector, Africa’s corporate VC “rebound” is just fintech’s rebound renamed.

🔮 𝗣𝗿𝗲𝗱𝗶𝗰𝘁𝗶𝗼𝗻 – 𝗛𝗼𝘄 𝗧𝗼 𝗧𝗿𝗮𝗰𝗸 𝗜𝗳 𝗧𝗵𝗶𝘀 𝗜𝘀 𝗥𝗲𝗮𝗹:

By June 2026 (H1 2026 results): — If corporate deals hit 30+, this trend has momentum — If deals fall below 20, H1 2025 was a blip driven by a few large funds deploying capital they already raised

By December 2026: — Watch how many H1 2025 corporate-backed startups raise follow-on rounds at flat/up valuations — If 50%+ raise follow-on capital, corporate investors picked well — If 70%+ are stuck or down-round, corporates deployed badly

By March 2027: — Track how many of the 26 H1 2025 startups have been acquired by their corporate investors or competitors — If 3+ acquisitions happen, this validates the strategic investment thesis — If zero acquisitions and zero follow-on funding, corporate VC was tourism, not strategy

Benchmark to watch: OCP’s Bidra Innovation Ventures deployed from a $250M fund with up to $5M checks. If they complete 10+ deals by end 2026, African corporate VC has scaled. If they deploy <5 deals, even the biggest funds struggle to find quality.

The real test isn’t whether 26 deals happened in H1 2025. It’s whether these startups survive, scale, and create returns (strategic or financial) that justify corporate investors coming back in 2026, 2027, and beyond.

Learn more: https://www.techinafrica.com/corporate-vc-hits-3-year-high-26-deals-44-jump-african-startups-going-global/

Follow me for more African startup and funding insights.

Join our WhatsApp channel: https://whatsapp.com/channel/0029Vb3xgMr42DcfICgi7T1N

#AfricanStartups #CorporateVC #VentureCapital #Fintech #Agritech #StartupFunding

By March 2027: — Track how many of the 26 H1 2025 startups have been acquired by their corporate investors or competitors — If 3+ acquisitions happen, this validates the strategic investment thesis — If zero acquisitions and zero follow-on funding, corporate VC was tourism, not strategy

Benchmark to watch: OCP’s Bidra Innovation Ventures deployed from a $250M fund with up to $5M checks. If they complete 10+ deals by end 2026, African corporate VC has scaled. If they deploy <5 deals, even the biggest funds struggle to find quality.

The real test isn’t whether 26 deals happened in H1 2025. It’s whether these startups survive, scale, and create returns (strategic or financial) that justify corporate investors coming back in 2026, 2027, and beyond.

Want more analysis like this? I break down African funding news every week using the same framework VCs use: numbers that matter, business model reality checks, and falsifiable predictions. No press release regurgitation. Subscribe to get these in your inbox: https://substack.com/@udokanzemeke?r=5d7xxj&utm_medium=ios